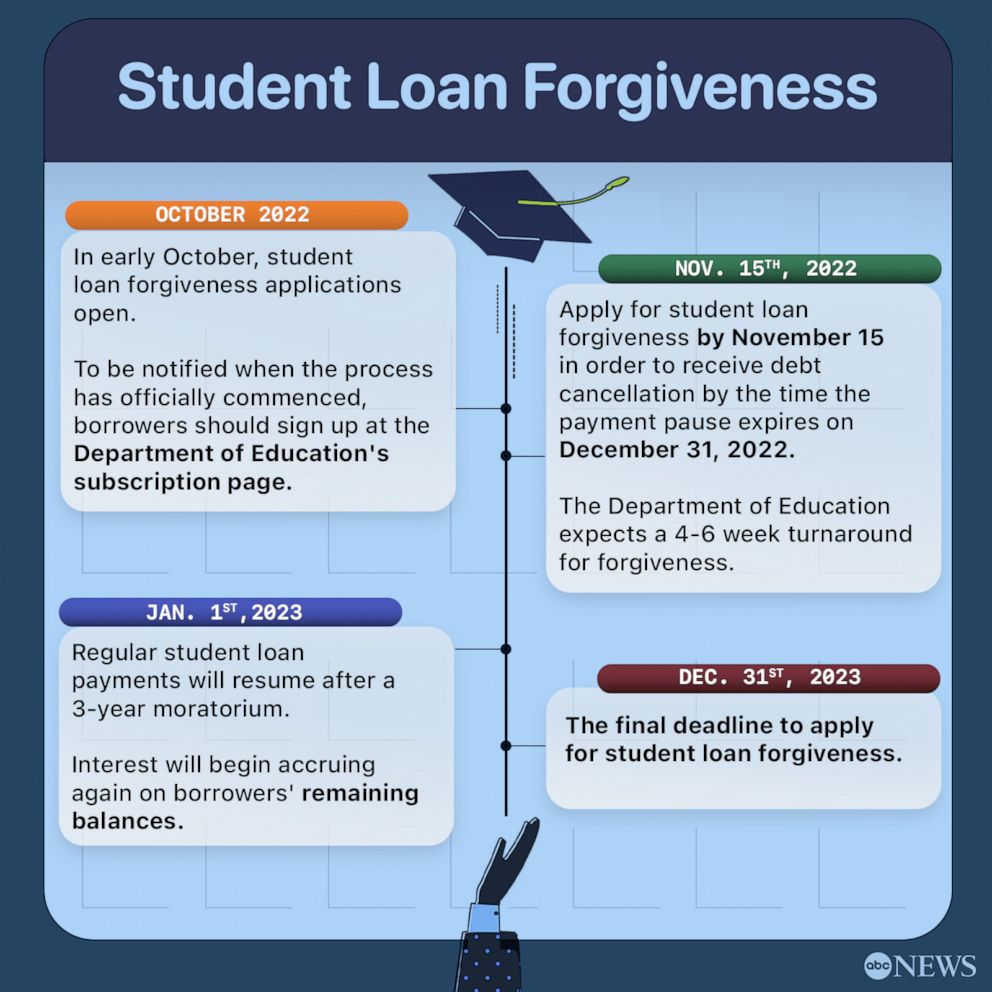

The student loan forgiveness application is now live, and eligible borrowers can apply for partial or full discharge of their loans. This is a great opportunity for those who are struggling with student debt to get some relief. The application process is easy and fast, so there is no excuse not to apply. This program can help millions of Americans get out of debt and start fresh. So don’t miss out on this chance to get your student loans forgiven.

What is Student Loan Forgiveness?

Loan forgiveness is when you are released from your obligation to repay part, or all, of your student loan debt. Borrowers who have taken out federal student loans may be eligible for loan forgiveness under certain circumstances. For example, if you are a teacher working in a low-income school or if you work in a public service job, you may be eligible for loan forgiveness. President Joe Biden’s plan would cancel up to $10,000 in federal student loan debt for individual borrowers who earn less than $125,000 a year. This would provide much needed relief to borrowers who are struggling to repay their loans. If you think you may be eligible for loan forgiveness, you can fill out a short form on the Department of Education’s website.

The Education Department is now accepting applications through its student loan debt forgiveness form.

Americans with federal student loans can apply for up to $20,000 in debt relief through the form.

The Department of Education says that applications submitted during the beta period will be processed as borrowers apply for forgiveness.

This means that Americans with federal student loans can begin the process of having their debt forgiven.

President Joe Biden on Monday officially kicked off the application process for his student debt cancellation program and announced that applications are now open.

“We’re accepting applications to help us refine our processes ahead of the official form launch,” says the Education Department in a statement. “This means that the Education Department will begin processing applications as borrowers apply for up to $20,000 in debt relief through the form.” Will I have to re-apply now that the form officially launched? No. The Education Department says that applications submitted during the beta period will be processed as borrowers apply for forgiveness.

Who is eligible to have their student loan debt canceled?

No student loan debt will be canceled until Oct. 23, 2022, at the earliest, as declared in the Education Department’s court document response to a lawsuit brought by several student loan borrowers. However, current students with loans are eligible for this debt relief. Borrowers who are dependent students will be eligible for relief based on their parents’ income and household size. Even if borrowers have a single income above $125,000 or a household income above $250,000 at the time of the announcement, they can still qualify as long as their income doesn’t exceed those thresholds when they apply for forgiveness.

Apply for Federal Student Loan Debt Relief OMB No. 1845-0167, Exp. Date 4/30/2023

The Student Loan Forgiveness Application will allow low- to middle-income borrowers the ability to have $10,000 of their student debt forgiven. The application process is simple, short, and easy to complete. This is an excellent opportunity for those who are struggling to repay their student loans.

How do you apply for student debt relief?

The application is available online at studentaid.gov/debt-relief/application. You will need to provide your name, date of birth, social security number, and other information. The form is available in both English and Spanish. You can apply for up to $20,000 in debt relief if you owe money on federal student loans.